The Quiet Storm at Volkswagen Group: Opportunity Hidden in the Chip & BEV Shuffle

What the latest supply‑chain, delivery and electric‑vehicle shifts mean for the VAG aftermarket and performance‑tuned world of NEUSPEED

A Supply‑Chain Win That’s More Tactical Than Triumphant

Here’s the twist: for all the headlines about chip shortages and vehicle production woes, Volkswagen Group’s leadership is quietly asserting they’ve “got enough chips for now.” CEO Oliver Blume told the German weekly *Bild* that, despite a looming Nexperia export ban from China, the Group is covered — for the moment. This is not cause for pop‑the‑champagne; it’s a strategic pause, not a victory lap.

What does that mean for the aftermarket/performance community? If VW is tentatively stable on logistics, that opens a narrower window for specialty suppliers and tuners to start threading the needle: sourcing parts (electronics, sensors, controllers), prepping older platforms while OEMs shift production focus, and preparing — in other words — for when the chip squeeze tightens again.

Deliveries Up – But the Electric Surge Masks Regional Weakness

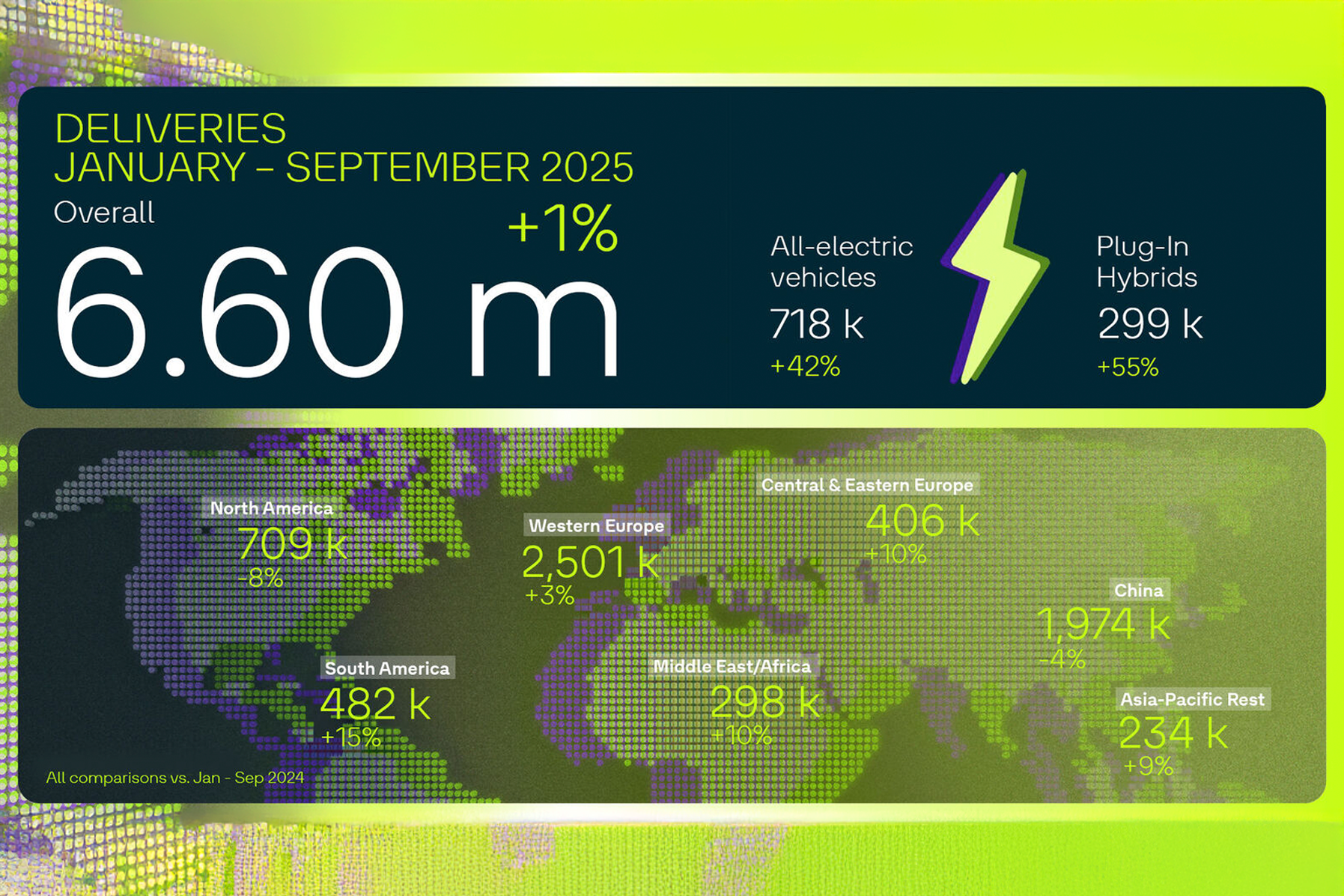

According to Volkswagen’s Sept 2025 global update, the Group delivered about 6.60 million vehicles after nine months — a 1 % rise year‑on‑year. On the surface, that’s solid. Dig a bit deeper: battery‑electric‑vehicle (BEV) deliveries surged by 42 % globally and 78 % in Europe. However, North America is still experiencing an 85% BEV growth from a low base; China remains weak, down approximately 4% overall due to model transitions.

For tuning houses and performance part purveyors like us at NEUSPEED, this mixed picture matters. A BEV‑driven ramp means fewer traditional ICE platforms to service — but also a bifurcated world: in some markets the ICE & early‑hybrid vehicles remain a rich hunting ground. Where OEMs shift resources to EVs, performance aftermarket capability becomes a differentiator.

The Aftermarket Sweet‑Spot: Legacy Platforms in Transition

While OEM focus accelerates on EVs, legacy platforms aren’t suddenly worthless — they’re golden. ICE and early‑hybrid variants of the Volkswagen Golf R, Audi S3, and similar models are seeing service lives extended or delayed upgrades. With OEM resources skewing toward electrification, the performance aftermarket opportunity widens: better margins, less OEM competition, deeper customization possibilities.

At NEUSPEED, that means doubling down on modular upgrades for MQB‑based platforms or tweaking tuning paths for the next‑gen OEM hybrids while EV‑focus draws lion’s share of OEM R&D. For our community, that’s not a problem — it’s a strategic window to own.

Still, Clouds on the Horizon — Smart Prepping Wins

The report on VW’s chip readiness came with caveats. The real risk isn’t “today” but “tomorrow.” OEMs talk about geopolitical fault‑lines, simplified chips used across sectors, and the fragility of the supply chain. Also, while delivery numbers rose, they did so on the back of EVs — and EV demand has regional choppiness (China down, Europe up). That unevenness introduces risk for specialty players who assume uniform growth across markets.

For the aftermarket scene: invest now in supply‑chain resilience. Have backup sourcing, design for compatibility across power‑train types, and monitor OEM model‑freeze announcements. This isn’t hype — the next “chip shock” will be a competitive advantage if you get ahead of it.

- OEMs like VW are temporarily stable on chip supply — not safe forever.

- BEV deliveries are the growth engine, but ICE/legacy platforms are still performance hotbeds.

- Aftermarket players get a strategic window while OEMs pivot to EVs.

- Supply‑chain foresight (electronics, sensors, controllers) will pay dividends.

- Regional demand disparities — especially China vs Europe — mean market‑specific tactics.